Contents

From ancient Greek merchants attempting to claim insurance by sinking their ships to Roman armies selling the Emperor’s throne. Since time began, fraudsters have been willing to try their luck whenever a system is open to exploitation.

And succeeding.

However, most historical crimes were essentially isolated events. While a single fraudster could be a repeat offender, compared to the number of people who can be duped across different digital channels, fraud has become much more of an everyday concern for everyone.

But how did we get to this point? What risks do we need to be aware of right now? What can we do about it?

A history of digital deviance

Like other forms of fraud, digital scams date back further than you might think. Email phishing allegedly first took place in the early 1970s, although it’s generally accepted that the term was coined, and the practice became commonplace in the mid-1990s.

Since then, the online world has seen con artists try their hand at everything from fake email addresses to using information gleaned from massive data breaches, with $47 million being the most amount of money a single person has lost to an email scam.

Incidentally, the most famous email scam, the 419, aka Advance-fee, aka The Nigerian Prince scam, surfaced as mail fraud some 100 years ago.

But email isn’t the only digital channel that’s been hijacked. The very first mobile phone scams emerged during the high-flying 80s—way before they were popular.

Text messages requesting funds be “quickly sent” to a specific account by a family member began soon after, though again didn’t surge in number until well into the 90s when uptake soared.

Of course, these aren’t the only forms of online fraud surfacing at the start of the popularity of the Internet. Password theft, website hacks, and spyware – among others – proliferated at an alarming rate worldwide at a similar time. Not to mention the creation of fake accounts on various platforms.

One of the biggest problems we face today is the ease with which online fraud can take place.

Hackers continue to evolve their skills in line with advances in tech. But when you consider the number of websites that anyone can access; the marketplaces and classified websites/apps that rely on user-generated content – pretty much anyone can find a way to cheat these systems and those that use them.

Dangers of AI scams

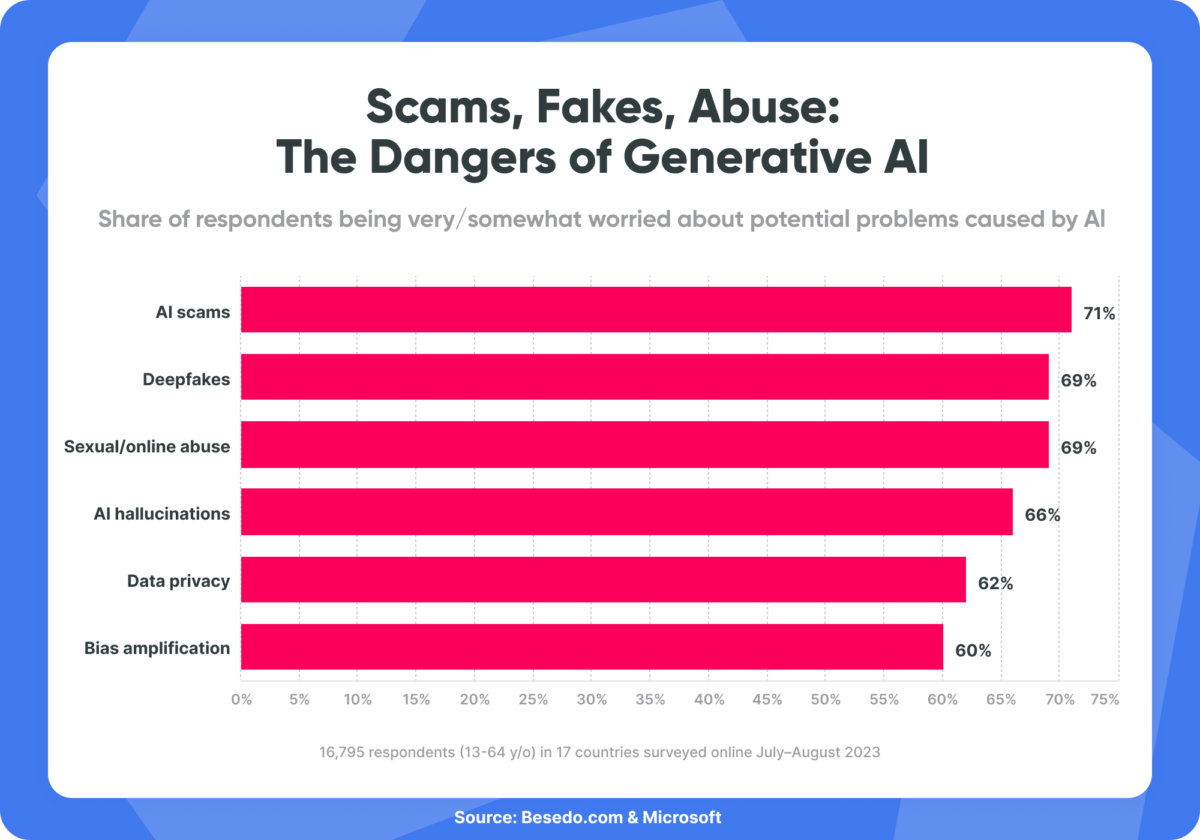

Fraud follows trends, and AI is no exception. A recent survey by Microsoft shows online users worldwide are most worried about fakes, scams, and abuse.

71 percent of respondents across 17 countries surveyed by Microsoft in July and August 2023 were very or somewhat worried about AI-assisted scams. Without further clarifying what constitutes this kind of scam, it is most likely connected to the impersonation of a person in the public eye, a government official, or a close acquaintance of the respondents. Tying for second are deepfakes and sexual or online abuse, with 69 percent.

AI hallucinations, defined as chatbots like ChatGPT presenting nonsensical answers as facts due to issues with the training material, come in fourth. At the same time, data privacy concerns related to large language models being trained on publicly available data of users without their explicit consent take fifth place with 62 percent.

Overall, 87 percent of respondents were worried at least somewhat about one problematic AI scenario.

Events are particularly sensitive

Scammers operate with alarming regularity all year round. However, they’re much more active around specific retail events:

- Black Friday

- Christmas

- January sales

- Back-to-school accommodation searches

- Chinese New Year.

However, while 2020 was shaping up to be a landmark year for fraudsters, given the many different sporting and cultural events like the Euro 2020 and Copa Americas football tournaments and, of course, the Summer Olympics, fate had very different plans for all of us: the COVID-19 pandemic.

However, true to form, scammers are not above using an international healthcare crisis to cheat others. COVID-19 has given rise to different challenges and opportunities for online businesses. For example:

- Video conferencing services

- Delivery apps

- Dating websites

- Marketplaces

These have largely been financially advantageous, given they are digital services.

However, given the knock-on economic factors of coronavirus, there may be wider-reaching behavioral shifts to consider.

Fraudulent behavior seems to adapt to any environment. In the UK, research shows that over a third (36%) of people have been the target of scammers during the lockdown. Nearly two-thirds said they were concerned that someone they knew could be targeted.

Examples of scams playing on the fear of contamination include the sale of home protection products, while other more finance-focused scams include fake government grants (requesting personal information), help with credit applications (for a fee), and even investment opportunities promising recession-proof returns for those with enough Bitcoin to invest in such schemes.

The gap is closing

It’s clear that online fraud is closely aligned with wider trends. In fact, the newer something is, the more likely scammers are likely to step in. Looking at the various timelines of many of these scams against when the technology was first invented, it’s clear that the gap between the two is closing as time progresses.

There’s a very good reason for this: the pace of adoption. Basically, the more people there use a particular device or piece of software, the more prolific specific types of scams have become.

Consider the release of the latest iPhone an event that gives fraudsters enough incentive to target innocent users.

The launch of the new iPhone preys upon consumer desire and manipulates Apple fans into buying the latest technology. As with most eCommerce scams, this is often done with promises of delivery before the official launch date.

Not only that, but the accompanying hype around the launch proved the perfect time for fraudsters to offer other mobile phone-orientated scams.

Catch ’em all

In general, new tech and trends lead to new scams. For instance, Pokémon Go introduced new scams such as the Pokémon Taxi. So-called expert drivers literally were taking users for a ride to locations where rare Pokémon were said to frequent.

The fact it was so new and its popularity surged in such a short period of time made it a whole lot easier for fraud to materialize. Essentially, there was no precedent set – no history of usage. No one knew what exactly to anticipate. As a result, scams materialized as quickly as new users signed up.

In one case, players were tricked into paying for access as new server space was needed. Not paying the $12.99 requested would freeze their Pokemon Go accounts. While that might be a small price to pay for one person, it would mean a significant amount at scale.

Moderation methods

Regardless of their methods, fraudsters are ultimately focused on one thing. Whether they’re using ransomware to lock out users from their data, posting too-good-to-be-true offers on an online marketplace, or manipulating lonely and vulnerable people on a dating app – the end result is cold hard cash through scalable methods.

Hackers will barge their way into digital environments. Those using online marketplaces and classifieds sites must worm their way into their chosen environment. In doing so, they often leave behind many clues that experienced moderators can detect.

For example, the practice of ad modification or Trojan ads on public marketplaces follows particular patterns of user behavior that can raise alarm bells.

Take appropriate steps

So, what can marketplace and classified site owners do to stay ahead of fraudsters? A lot, in fact. Awareness is undoubtedly the first step to countering scams, but that alone will only raise suspicion than act as a preventative measure.

Data analysis is another important step. But, again, the biggest issue is reviewing and moderating at scale. So how can a small moderation team police every single post or interaction when thousands are created daily?

This is where moderation technology – such as filters – can help weed out suspicious activity and flag possible fraud.

To stay ahead of fraudsters, you need a combination of human expertise, AI, and filters. While marketplace owners can train AI to recognize these patterns at scale, completely new scams won’t be picked up by AI (as it relies on being trained on a dataset). This is where experienced and informed moderators can add value.

People who follow scam trends and spot new instances of fraud quickly are on full alert during big global and local events. They can quickly create and apply the right filters and begin building the dataset on which the AI will be trained.

Summary and key takeaways

Ultimately, as tech advances, so too will scams. And while we can’t predict what’s around the corner, adopting an approach to digital moderation that’s agile enough to move with your customers’ demands—and with fast intervention when new scam trends appear—is the only way to future-proof your site.

After all, prevention is much better than a cure. But a blend of speed, awareness, and action is just as critical in the case of fraud.

If you’re concerned about fraud and scams on your platform, we are always available for a chat – no strings attached.

Ahem… tap, tap… is this thing on? 🎙️

We’re Besedo and we provide content moderation tools and services to companies all over the world. Often behind the scenes.

Want to learn more? Check out our homepage and use cases.

And above all, don’t hesitate to contact us if you have questions or want a demo.